Most people avoid thinking about their own mortality; however, planning ahead can make a significant difference. Funeral insurance, also called burial or final expense life insurance, covers funeral expenses and related costs. Choosing a life insurance policy like this helps ensure your loved ones are not burdened with unexpected financial responsibilities. By understanding your options, you can secure peace of mind for your family during a difficult time.

Funeral Insurance

When considering a policy, you should first think about which costs you need to cover. Funeral expenses often include the casket, burial plot, cremation, flowers, and outstanding medical bills. By purchasing a policy, you help guarantee that these costs are covered. As a result, you spare your family from unexpected financial stress and difficult decisions during their time of grief.

Life Insurance

Life insurance offers many benefits beyond a traditional payout. Unlike standard life insurance policies, funeral insurance specifically covers all related expenses. This specialized coverage provides peace of mind by ensuring the financial aspects of your departure are handled smoothly for your loved ones.

When buying a policy, it is important to find a policy that fits both your circumstances and your budget. Most policies are available without requiring a medical exam, making qualification much easier. You can usually choose a coverage amount based on your individual needs, and many insurers offer customizable plans. Knowing your expected funeral costs helps you tailor your funeral insurance policy to match your final wishes.

Pre-Planning Benefits

Another important factor to consider is the age at which you purchase funeral insurance. The earlier you invest, the lower your premiums will likely be. Since premiums often increase with age, buying a funeral insurance policy young can save you money long-term. Additionally, many plans do not require a health assessment, meaning your rates usually stay unaffected by later health changes.

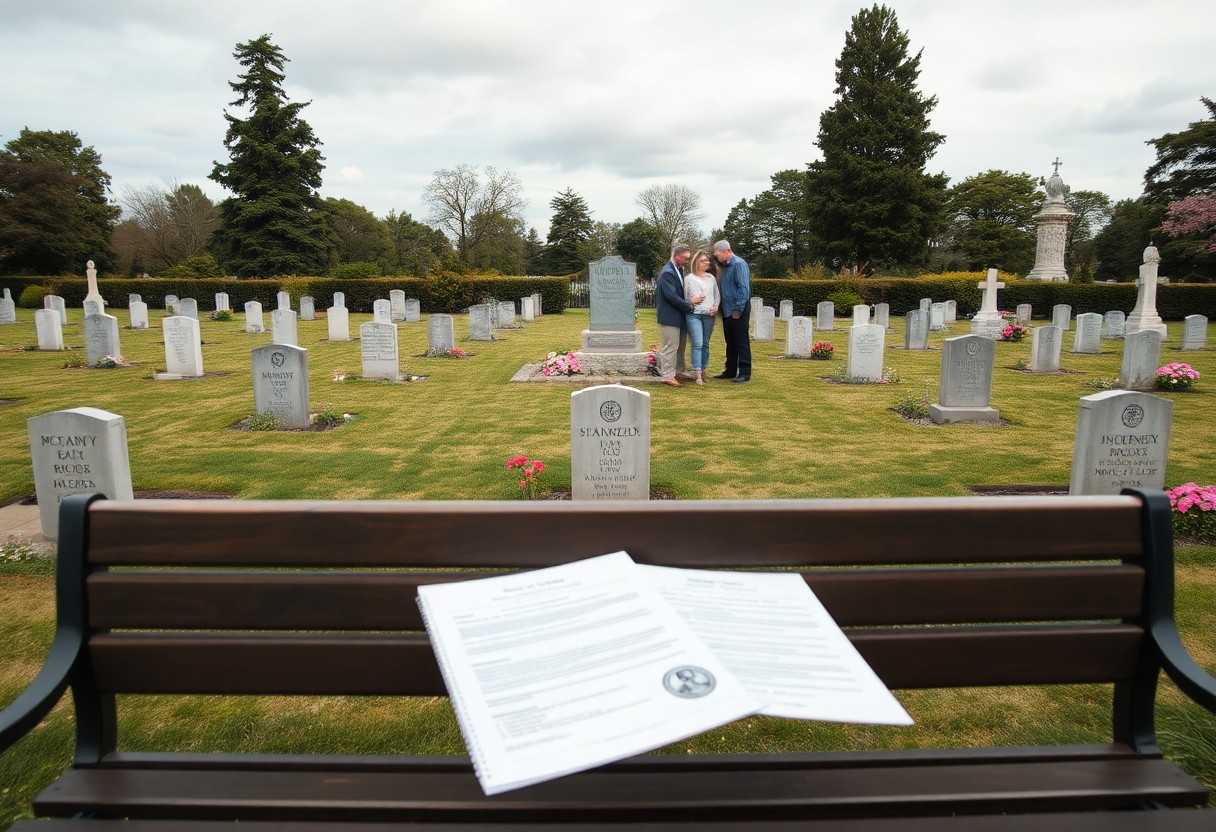

Besides providing essential financial support, funeral insurance also reduces the emotional burden on your family during a difficult time. By pre-planning your funeral and sharing your wishes, you allow your loved ones to focus on celebrating your life. Ultimately, this thoughtful preparation creates lasting memories and provides comfort to those you leave behind.

Therefore, funeral insurance is a practical and compassionate choice for anyone looking to alleviate the future burden on their families. By planning ahead with life insurance, you not only ensure that your final expenses are covered but also provide your loved ones the gift of peace during their time of mourning. Consider taking that step today, so you can lead to a conscientious, responsible, and supportive exit for your family when the time comes.